Why PropiRR

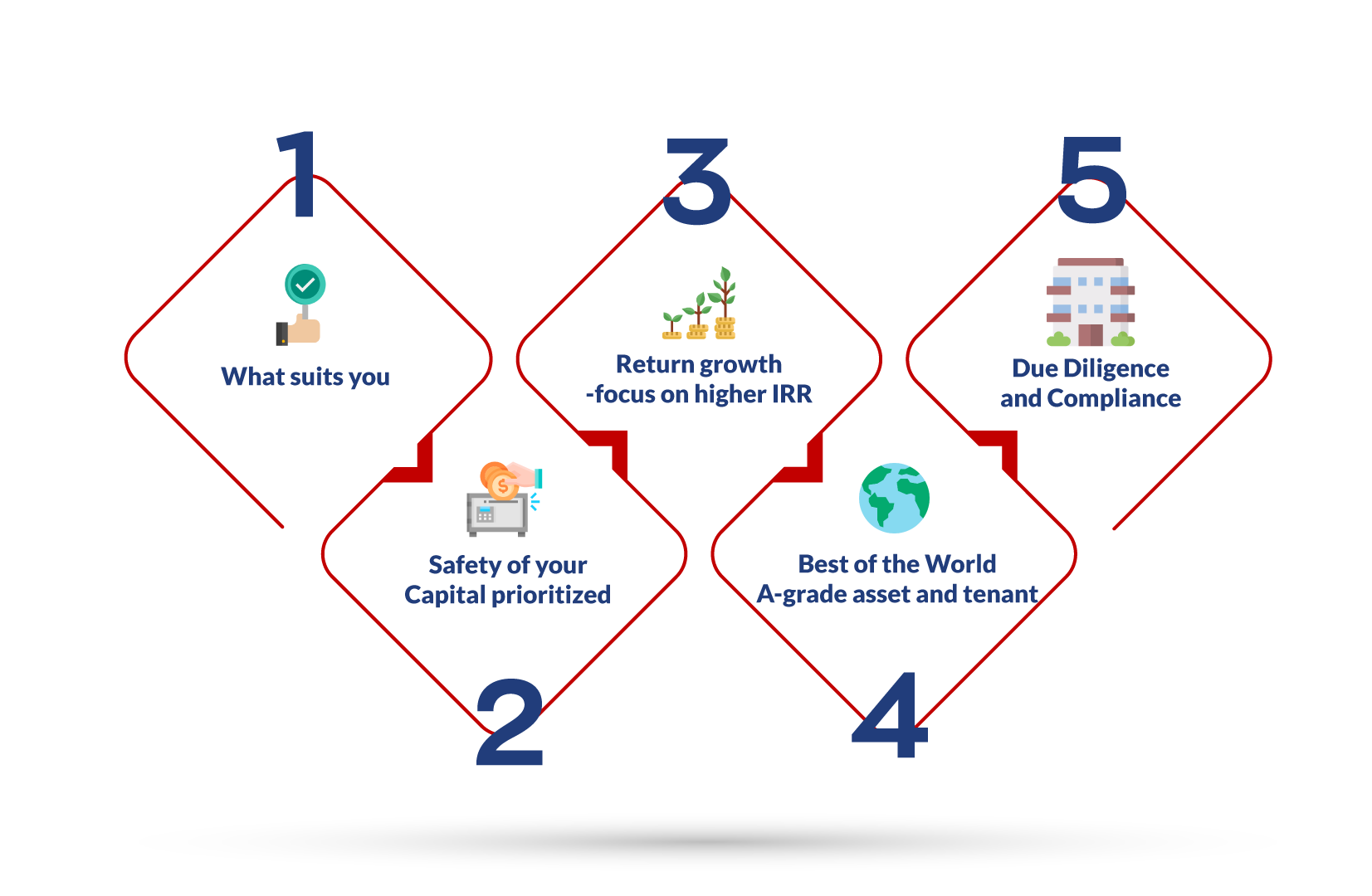

v Our expert team will guide to the best IRR for your monthly income.

v

Ownership in A+ Grade Property.

v

Stable and well-established

tenant.

v

Team Expertise in reviewing,

executing and delivering returns on property.

v

Ensure asset management with

focus on enhancing property value.

v

Transparent dealings.

v Convenience of technology and enabling desired liquidity.

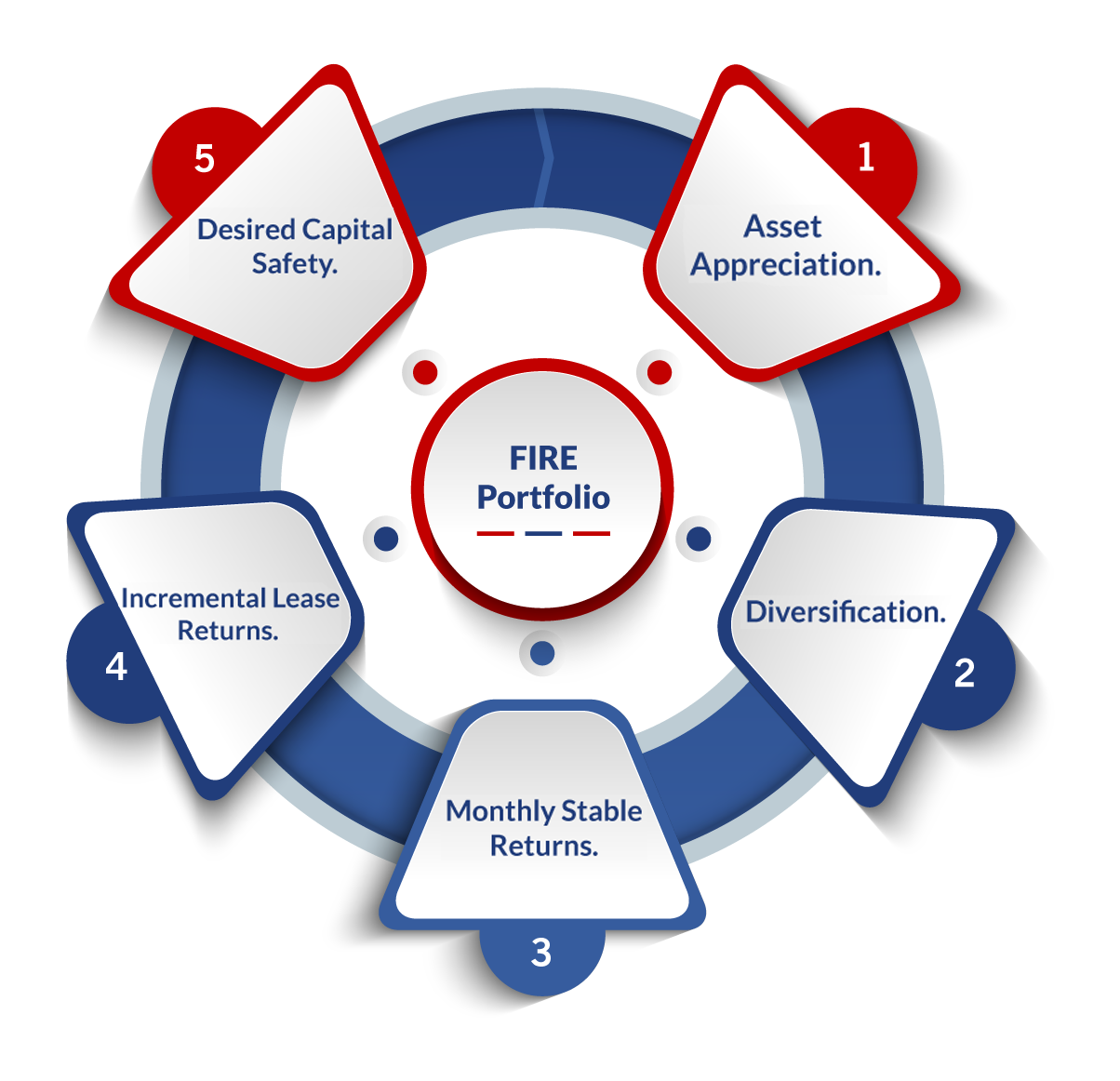

There are multiple advantages by investing money in a stable and high yield asset which has guaranteed yield growth year and year.

In a volatile & uncertain economic environment it is important

that we PLAN our investments for generating returns which are balanced and as

per our Goals. In this endeavor we keep advising client to have a well

distributed asset class including Real Estate…every individual has an average

29% of networth in Real estate. Is your investments skewed to volatile asset

class to generate 10-12% IRR .Time to take our guidance to make the best of

your investment.